It is unlike us at QO to project the negativity of the world as it is as, like our platform, we like to offer solutions to problems.

But there is no denying the severity to businesses when they fail to comply with regulatory requirements – and there is no time like now to prevent failure. The impact is not industry specific; the severity of failing any regulatory requirements does not offer any respite.

What’s the state of play with Regulatory compliance – what’s the confusion?

In short – it’s complex and only going to increase with complexity and businesses really need to get their ducks in a row to be in a position to remain compliant and not face any fines or penalties for failure of assessment.

The key reasons for confusion include:

- Complexity of regulatory compliance

- More and more regulations thrown into the mix

- Regulations that are changing

- Overlapping Regulations

- Risk Aversion

We will delve into the detail of these points, later in the blog, including the severity of impact to your business for non compliance.

How does the inclusion of Continuous Monitoring impact the potential of non-compliance?

Regardless of industry, continuous monitoring is now being included in compliance frameworks. NIST, PCI, SOC2 and ISO all now include continuous monitoring and businesses are going to need to need to consider how they include that in their forward strategies. Ultimately, regulatory compliance is hard to prove if you cannot comply with core elements of the framework and will therefore be immediate fail if you are not monitoring your environment, continuously.

What can businesses do to ensure they remain compliant and avoid fines?

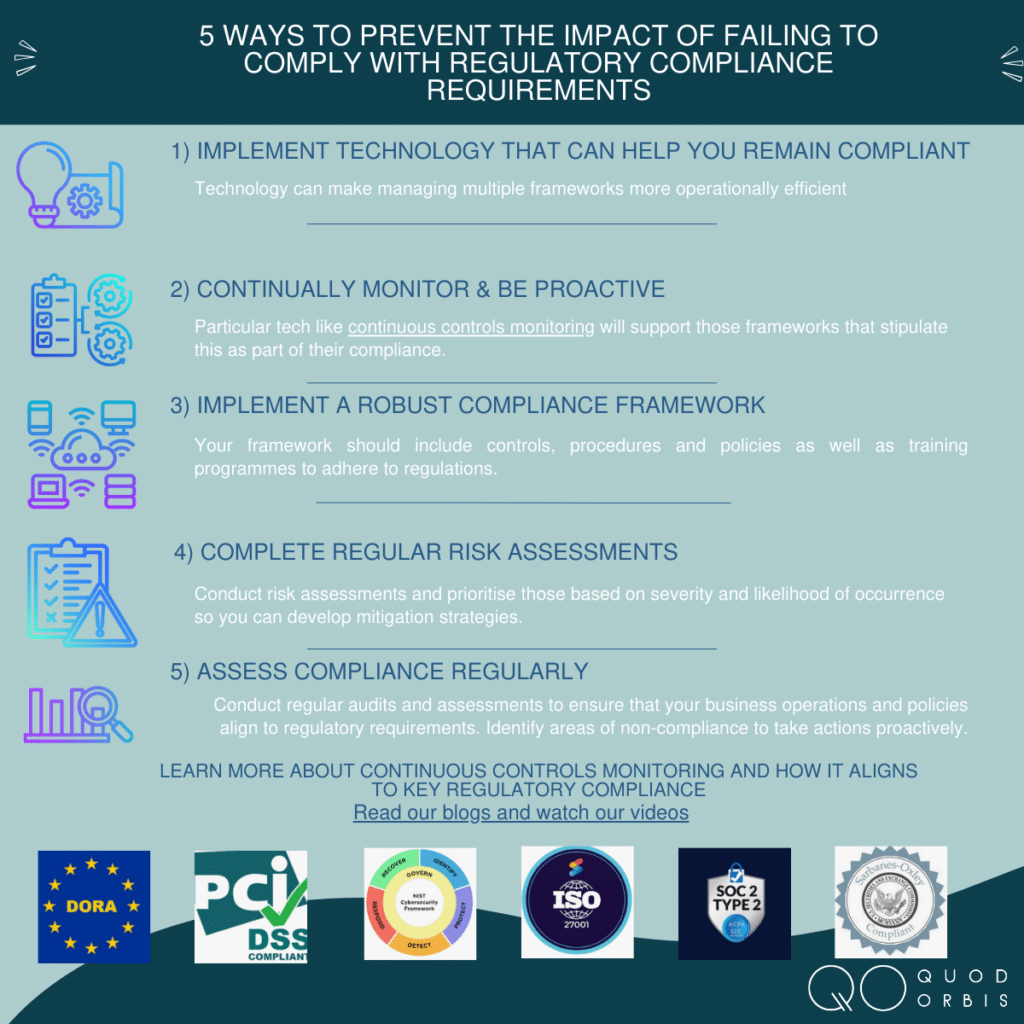

These are our top tips for staying compliant:

- Implement technology that can help you remain compliant: Technology can be a key driver for remaining compliant. Whilst many organisations will have multiple frameworks to manage, there is also huge cross over with the controls that have to be adhered to.

- That technology should have the capacity to continually monitor & be proactive: So technology not only will help manage multiple frameworks, but particular tech like continuous controls monitoring will support those frameworks that stipulate this as part of their compliance.

- Stay Up to Date: Keeping on top of updates is really the only way to manage all this – challenging we know! Regulatory monitor updates and changes as much as you can!

- Implement a Robust Compliance Framework: Your framework should include controls, procedures and policies as well as training programmes to adhere to regulations.

- Complete Regular Risk Assessments: To identify potential risk and vulnerabilities that would lead to failure of compliance. Conduct risk assessments and prioritise those based on severity and likelihood of occurrence so you can develop mitigation strategies.

- Assign responsibility and train your teams: Clearly define roles and accountability ensuring you have sufficient training in place that allows the whole organisation to understand their role to play.

- Assess compliance regularly: Conduct regular audits and assessments to ensure that your business operations and policies align to regulatory requirements. Identify areas of non-compliance to take actions proactively.

- Vet your Third parties: Your third parties are a potential threat – ensure you vet them sufficiently and implement due diligent processes to ensure that remain compliant in the frameworks you need them to.

- Communicate with Legal Counsel: Specialists in regulatory compliance will support your business in interpreting regulations accurately and ensuring compliance with applicable laws.

- Be transparent and responsive: Open communication with regulatory compliance and addressing enquiries promptly will minimise any impact on potential regulatory fines.

By adopting these strategies and prioritizing regulatory compliance within their operations, businesses can mitigate the high severity impact of failing to comply with regulatory requirements.

Here’s the detail now of why regulatory compliance is causing so much complication to organisations who are trying to comply:

Complexity of regulatory compliance

Here’s the thing though – which if you work in compliance you will know – not all regulatory compliance is formally assessed where organisations receive certification from an external assessor. Those that are include ISO 27001, PCI DSS, HIPAA, SOC2, GDPR, CMMC and FISMA (USA Federal Information Security Management Act). In all cases, you must prove compliance and a certification is issued on meeting those requirements. In many circumstances, from one certification to the next, a noticeable improvement has to be demonstrated for recertification.

However, some regulations are frameworks that businesses can work toward – tick the boxes and say they are compliant. That’s great – except many have bypassed processes and completed the necessary elements in order to say they are compliant as, let’s face it, regulatory compliance is costly for businesses to maintain.

More and more regulations thrown into the mix.

DORA as an example is coming into play in 2025 and we imagine that businesses have not even begun to engage with that one as they are already chasing compliance status in their other regulations.

Regulations that are changing

PCI DSS is due for updates in March as an example and, with increasing regulatory change, organisations are swimming in a sea of updates and work to simply keep their head above water! Businesses may struggle to interpret and apply these regulations correctly to their specific circumstances, let alone keeping up with regulatory changes if you operate in different countries where global regulatory compliance can add another layer of complexity.

Also, many regulations are adding in additional requirements such as continuous monitoring which is layering more complexity.

Overlapping Regulations

Some regulations may overlap or have interconnected requirements. Navigating these overlaps and ensuring compliance with all relevant regulations can be confusing.

Risk Aversion

Due to the potential legal and financial consequences of non-compliance, businesses may adopt a risk-averse approach. This may involve dedicating significant resources to compliance efforts, contributing to the perception of complexity.

The Severity of non-compliance to a business

Despite having a wealth of complexity within the regulatory compliance world, the severity of consequences should it be proven that a business is noncompliant, is far more catastrophic.

Fines & Penalties imposed.

Regulatory agencies have the authority to impose fines and penalties on businesses that fail to comply with regulations. These fines can vary in severity depending on the nature and extent of the non-compliance. PCI DSS for example could be anything in the range of 5-100K dollars a month.

Legal Action

Non-compliance may lead to legal action, including lawsuits or regulatory enforcement proceedings. This can result in costly litigation, damage to the company’s reputation, and potential court-ordered remedies. In breaking one regulation, you may also break for example – GDPR which could impose further fines of up to 20 million euros or 4% of your annual turnover. British Airways for example was fined 183 million for breaching GDPR.

Financial Loss

The cost of fines, legal fees and any remediation efforts can have a significant impact on any business as well as noncompliance impacting future financial investments and credit ratings.

Criminal Liability

In cases of serious or willful non-compliance, individuals within the company, such as executives or managers, may face criminal charges including fines, imprisonment or disqualification from holding certain positions in the future.

Operational Damage processes

Non-compliance will require a major operational shift to invest in new processes and systems and all of this distracts from the main focus of the business. Regulatory authorities may also revoke or suspend licenses or certifications disrupting operations or affect an organisation’s ability to perform business.

Restrictions in the Market

Non-compliance can lead to restrictions on accessing the market they operate in, limiting a company’s ability to expand within their own and other markets.

Reputational & loss of competitive advantage damage

Undoubtedly, non-compliance will not only tarnish your reputation as a result of negative publicity but could also damage your ability to attract new business. This will irrevocably harm your competitive advantage; particularly where ethical and sustainable business practises are of the upmost value. Non-compliance will undermine your company’s position in the market and allow your competitors to take full competitive advantage – particularly if they maintain stringent compliance to the regulations they need to.

Ultimately, failure of noncompliance is so severe and multifaceted that it will affect every aspect of your business operations, finances, reputation and legal position. Productivity and commitment in your approach is the only way organisations can mitigate the risk of noncompliance and maintain longevity.

For more information on how Continuous Controls Monitoring can support your regulatory compliance then check out these pages: