Is automation the answer to businesses compliance complications and reduction of cyber risk in 2023

Every business has to comply with some type of regulatory law – some more than others. But it is likely that one of these – ISO, NIST, PCI, DORA – will resonate with you if you are responsible for managing compliance. However, so many contributing factors are now making compliance challenging and being able to evolve, adapt and remain compliant is now a pressing issue for compliance teams. So, can automating your compliance requirements be the key to solving the issues?

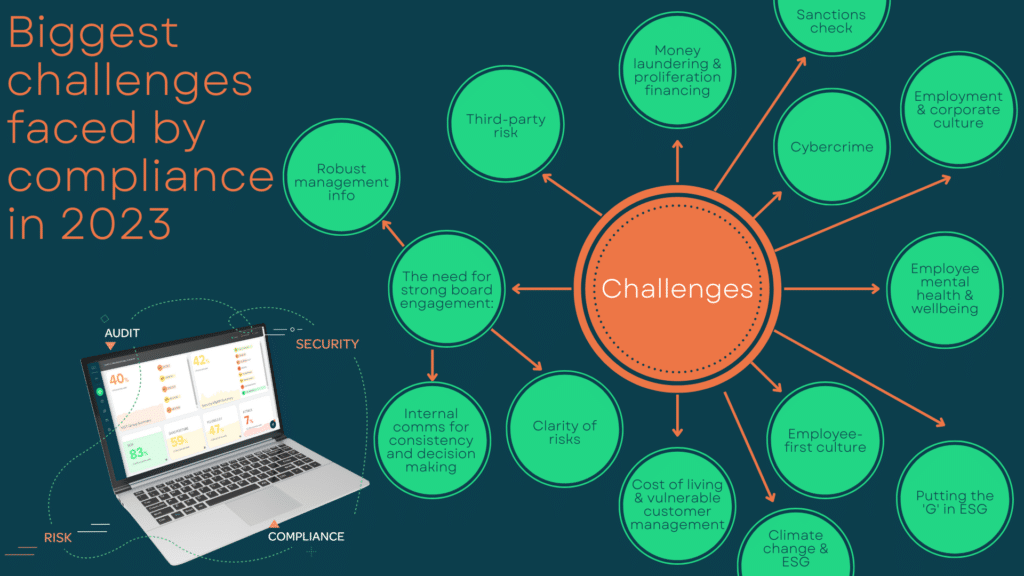

The business challenges faced by compliance teams in 2023

There are so many external and internal challenges now faced by compliance teams that the objective to be continuously compliant, and have constant assurance that you are, is potentially overwhelming. With external challenges involving geopolitical issues focused on – the Russia/Ukraine war as well as market fluctuations – cyber security, third party risk as well as ESG and evolving financial regulatory demands already mean that complaince teams have a considerable amount to contend with.

Couple that with internal frustrations:

- The desire for strong board engagement,

- The need for robust management information,

- A call for consistency with internal communications and decision making and ultimately total clarity of risk – be that cyber or operational.

All this culminates in perplexing issues leaving gaps in compliance and leaving chinks, if not large gaping holes in your operational resilience.

Changes in the regulatory environment – lacking in clarity or clear as day, things are always changing.

So much movement in regulatory compliance can often mean that it is hard to prioritise what to focus on.

Climate: In 2022 BCBS published FAQ’s stating that it expected climate risks to be incorporated into certain parts of the Pillar 1 frameworks – but that still remains unclear. But what is also expected is that climate risks will be incorporated into solvency stress testing.

Financial: New EU & UK regulatory frameworks will increase oversight to digital assets – DORA’s January 2025 deadline may seem like some time away, but rapid progress will need to be progressed throughout 2023. Also, with policy work largely finalised, businesses will need to focus on operational resilience and there will be a need for tangible evidence of progress of building that resilience. Banks and insurers are faced with significant re-design of their respective capital frameworks and will come into focus this year. Plus, whilst AMLA – the EU’s new financial crime supervisor – will not be up and running this year standards will be raised in anticipation and 2023 should be the transition year. However, never under-estimate the intense supervision of the FCA who will increase action against companies that are not compliant.

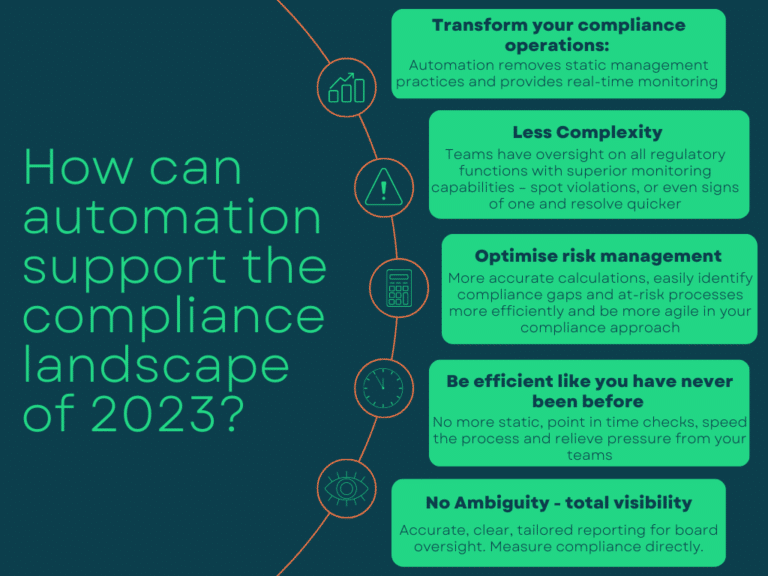

How can automation support the compliance landscape of 2023?

One eye on the changes that you know and one eye on ambiguity about what’s coming down the road tossed in with all the challenges, makes this a very potent concoction that is potentially dangerous for any business, regardless of the industry. Woven together are the compliance obligations and ensuring that business is operationally resilient, and that cyber risk is reduced. So In order to alleviate these pressures, automation is key for any business in any industry in protecting your regulatory demands and obligations:

Transform your compliance operations: by automating, your compliance teams remove themselves from static management practices by being constantly aware of the current status of compliance through real-time monitoring.

Untangle the complex nature of compliance: preventing compliance violations within what is already, and will continue to become, a further-complicated ecosystem will only be solved by automation. Regulatory teams will have oversight on all regulatory functions with superior monitoring capabilities – you will be able to spot violations, or even signs of one and resolve them quicker than before.

Optimise risk management – automation encourages regulators to make calculations more accurate and efficient than before, which makes it easier to identify compliance gaps and at-risk processes more efficiently than before. Therefore, you can be assured of a more agile in your compliance approach

Be efficient like you have never been before – automating and removing your business from static – point in time checks on your regulatory compliance is not only an inaccurate view of your compliance posture, but really very labour intensive. Automating speeds the process, alleviates the pressures on your team to collate information and provides total assurance of your compliance status.

Remove ambiguity in reporting: reporting becomes quicker, clearer and more accurate and Board oversight and explanations become clearer as you can use automation to create reports tailored for high-level understanding of regulatory risk and status.

It’s all about visibility: Without visibility how can you know anything? Automating the process means that you are directly linked to the regulations and how your business is performing against them.

Ultimately, regulatory change is here to stay and will continue to evolve as we cope with external and internal challenges – the challenge as a business will be whether you can afford not to allow automation to speed the process and provide that single source of truth to your compliance status – continuously.

Have you delved into how the QO platform can support your compliance visibility? Read about our continuous controls monitoring platform here.